What I also would like to mention regarding the company's future growth perspectives is the weakening demand for the overall EV market. Therefore, I believe that LCID revenue projections for the next decade are way too optimistic because they are significantly higher than the overall market growth trajectory. According to Precedence Research, the EV market size is estimated at approximately $1.7 trillion in 2032, meaning the market will compound at about a 23% yearly rate. Any figure can be helpful only compared to context, so I would like to compare projected LCID topline growth with the expected EV market growth. If we turn to consensus estimates, we can see that analysts expect the company to break even in terms of EPS in FY 2028, which is rather far from now, so I believe the level of uncertainty here is substantial.įrom the topline perspective, consensus estimates project revenue growth from approximately $1.4 billion in FY 2023 to $24.4 billion in FY 2032, representing a 10-year forward CAGR of above 33%. and what are the future growth perspectives. So we need to dig down to details to understand when the company is expected to turn profitable. Thus financial performance has been available only since FY 2019, and so arguably not very informative.īased on the above table, we can only conclude that the company had been ramping up its production last year and that costs by far outweigh revenue. Lucid is a relatively young company in the stock market.

The company operates in one operating and reporting segment, with the fiscal year ending December 31. In addition to its electric vehicles, Lucid is developing advanced battery technology and energy storage systems for homes and commercial buildings. The company expects to start production of the Gravity model in 2024. The company is also working on an electric SUV called Lucid Gravity. Lucid's first vehicle, the Lucid Air, is a luxury electric sedan with over 500 miles on a single charge, making it one of the longest-range electric vehicles on the market. The company is backed by several high-profile investors, including Saudi Arabia's sovereign wealth fund.

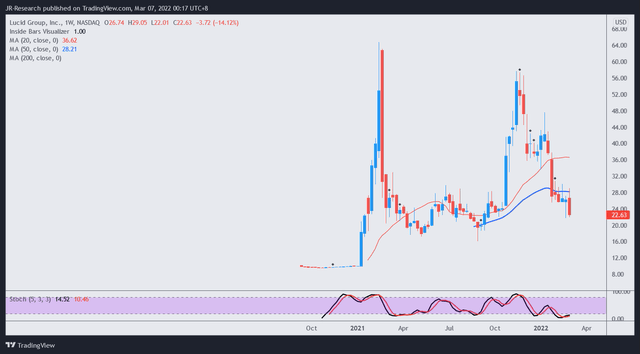

In 2016, the company shifted its focus to developing and producing luxury electric vehicles. The company was founded in 2007 under the Atieva name and initially focused on developing electric vehicle components and battery systems. Lucid is an American electric vehicle company based in Newark, California. Moreover, my valuation analysis suggests the stock is still significantly overvalued. The company is burning cash rapidly, and current cash reserves would be enough to finance operations only until Q1 2024, according to the company's CFO. Given the substantial uncertainty related to the company's sales growth and breakeven timing, I believe such a dramatic selloff was fair. Lucid Group's ( NASDAQ: LCID) stock price is now almost 90% down from November 2021 highs.

0 kommentar(er)

0 kommentar(er)